Published

by Sydney C in ChecksBy Sydney C

Published

Even with so many paper processes getting cut out of day-to-day operations, paper checks remain common, and even critical, for most businesses today. That means knowing how

The number one reason you need to endorse a business check properly is simple: fraud. By endorsing business checks properly, you will better protect yourself and your company from fraud resulting from lost or stolen checks.

For instance, endorsing a check as "For Deposit Only" (FDO) ensures that, should the check get lost, no one else can cash it except you. Banks call this a restrictive endorsement and it tells the bank

There are different restrictive endorsements, but they all serve the same purpose of preventing stolen deposits. When you use a restrictive endorsement on your check, it means you cannot pass it to a third-party for deposit.

Restrictive endorsements are of particular importance if you'll be mailing a check in for deposit or otherwise allowing it to leave your possession, putting it into a vulnerable state where it is more likely to get stolen.

You should note that you cannot undo a restrictive endorsement. Since banks stopped more than $17 billion in fraudulent transactions in 2016 alone, they take such endorsements seriously. If you place a restrictive endorsement on a check and then decide you want to pass it to a third-party, you must have the original issuer write a new check.

The only person who can endorse a check for deposit is the payee listed on the front of the check. For instance, if you write a check to "John Doe," John Doe must be the one to endorse the check.

If

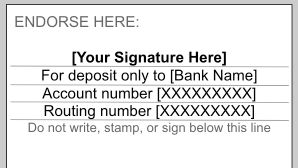

If it's a business check, any account holder can endorse the check and they need not sign their name. For instance, you can endorse it as: "For deposit only to account

There are five types of endorsements a payee can use:

Of all the various endorsements, you will most likely use a restrictive endorsement the most. Others, like conditional and special endorsements, have some uses within a business, but one that you should never use is the blank endorsement.

At the time of endorsing a check, find out who will ultimately receive the money and endorse it accordingly. If you will cash the check for yourself, consider a restrictive FDO endorsement to prevent another person from taking the money. Likewise, if a third party with endorse the money, choose the correct special or conditional endorsement accordingly.

Avoid these common mistakes and you'll be able to deposit any business check like a pro.

Many people are in the bad habit of depositing checks that they have not endorsed. Banks often accept these checks if they

If the person who wrote you the check spelled your name wrong, correct it when endorsing the check. Do so by writing the name, as they misspelled it, in the endorsement area with the correct spelling below it, then endorse as normal.

If you've ever made a mistake when writing or endorsing a check, it's important that you know how to address it properly. Keep in mind that you should always write using only a pen, not an erasable pencil. If you make a mistake, put one clear line through it and initial next to it.

Realize that it is up to the bank's discretion to cash a check with a mistake on it. If a check is beyond saving or if you have requested a replacement check, always write "VOID" across the front of the check so someone else cannot cash or misuse it at a later date.

The issuer should only sign the front of the check, but they may leave instructions on the back of the check. For instance, they might write: “Hold for deposit until December 30, 2019.” However, the bank may or may not follow these instructions when the check

As the payee, always sign and endorse in the "Endorsement Area" on the back of the check. There may be a box available that allows you to further restrict how the check

It may take a few times to get yourself in the habit of following these steps, but these steps are important for ensuring that fraudsters don't steal your business checks, or that your bank rejects your deposit

If you're in search of

Sydney C began writing professionally in 2014 when she took on a full-time position as a non-fiction content creator and researcher. While her career enables her to explore

Published

by Sydney C in Checks