Fill out and print your Actuarial Benefits & Design - Participant Deposit Slip for free

Do you need to deposit money at Actuarial Benefits & Design - Participant? Don't feel like going to the bank? No problem! Follow the instructions below to:

- Fill out your Actuarial Benefits & Design - Participant deposit slip form (free)

- Print out your Actuarial Benefits & Design - Participant deposit slip form (free)

- Print out an envelope with the deposit-by-mail address for your bank (free)

- Print out a paid stamp on your envelope ($1, optional)

- Create an account and save the record of your deposit, including a PDF of the deposit slip for your records (free)

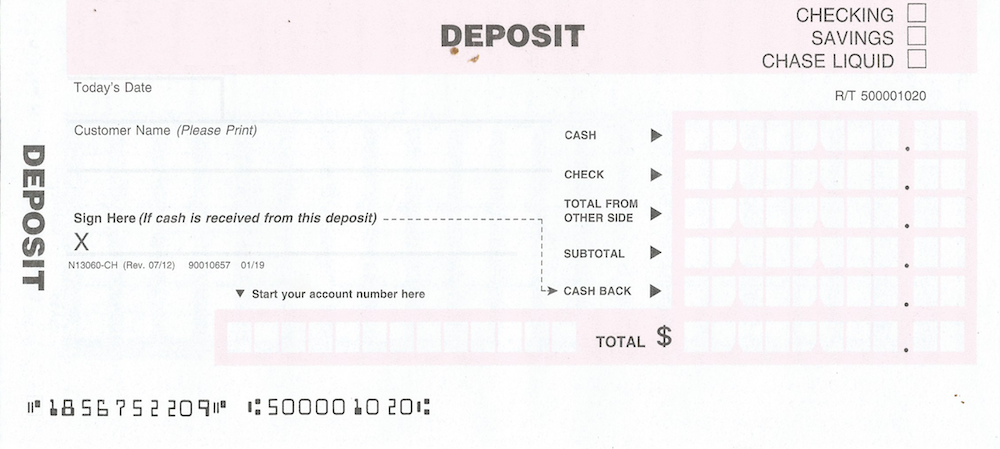

Fill out your deposit slip by following the instructions below to make sure your deposit is successful. Do NOT use this deposit slip, as the routing number may not match your account. If you want to download this Actuarial Benefits & Design - Participant Deposit Slip, click on the image.

Fill out your deposit slip by following the instructions below to make sure your deposit is successful. Do NOT use this deposit slip, as the routing number may not match your account. If you want to download this Actuarial Benefits & Design - Participant Deposit Slip, click on the image.

How to Get a Actuarial Benefits & Design - Participant Deposit Slip

You may be asking yourself, “How do I get a Actuarial Benefits & Design - Participant deposit slip?”

Maybe you don’t live close to a Actuarial Benefits & Design - Participant branch or ATM. Maybe you want to deposit checks too large for Actuarial Benefits & Design - Participant’s mobile app deposit limits (where you deposit checks by taking a photo). You have a few options:

- Call Actuarial Benefits & Design - Participant and order some in the mail: time needed: days

- Head to your nearest Actuarial Benefits & Design - Participant branch and pick one up: time needed: at least 30 minutes, probably more than an hour

- Grab one out of your Actuarial Benefits & Design - Participant checkbook: time needed: a few minutes, if you can find your checkbook

- BEST OPTION: Use CheckDeposit.io to create and print a Actuarial Benefits & Design - Participant deposit slip: time needed: a few minutes at most. Just fill in the information below to create your deposit slip now.

CheckDeposit.io's deposit slip template let’s you create a printable Actuarial Benefits & Design - Participant deposit slip in seconds. Fill in your information below and print out your deposit slip. Save your deposit slip PDF for recordkeeping

How to Fill Out a Actuarial Benefits & Design - Participant Deposit Slip

Filling out a Actuarial Benefits & Design - Participant Deposit Slip is simple, follow the instructions below. We will walk you through each step of filling out a Actuarial Benefits & Design - Participant Deposit slip. When finished, you can print out your deposit slip for no charge.

Step 1: Enter The Date of the Deposit

Enter today's date.

The Date of the Deposit

The Date of the Deposit

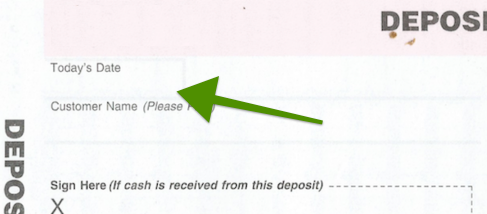

Step 2: Enter The Account Holder's Name

This is the name of a person listed on the account. If you're depositing to a business account, this can either be an account holder or the business name as it appears on the account.

The Name of The Customer or Company

The Name of The Customer or Company

Step 3: Enter The Company Name

This is the name of the company or organization, as it appears on the account. If you have any questions to what this is, check a recent statement to make sure the name matches exactly.

Step 4: Enter The Company or Account Holder's Address

The address of the company or organization, or account holder, as it appears on the account. If you have any questions to what this is, check a recent statement.

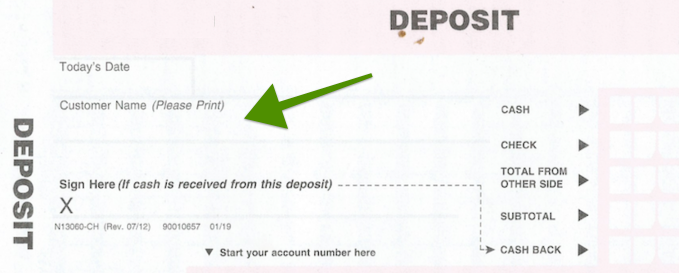

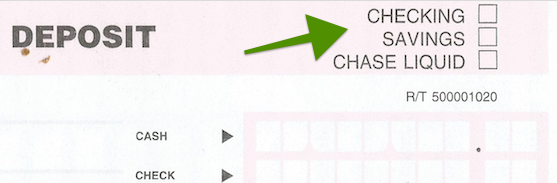

Step 5: Enter The Account Type

This will either be "Checking" or "Savings".

The type of account - checking or savings

The type of account - checking or savings

Step 6: Enter The Contact Name

The name of person the bank should contact with any deposit questions. This should be the person who fills out the deposit slip and is an account holder.

Step 7: Enter The Contact Phone Number & Email

The phone number of the account holder. The bank will call this number if they run into any questions with the deposit. Enter a number for the best person for the bank to talk to with deposit questions. Enter the contact email in case the bank reaches out by email.

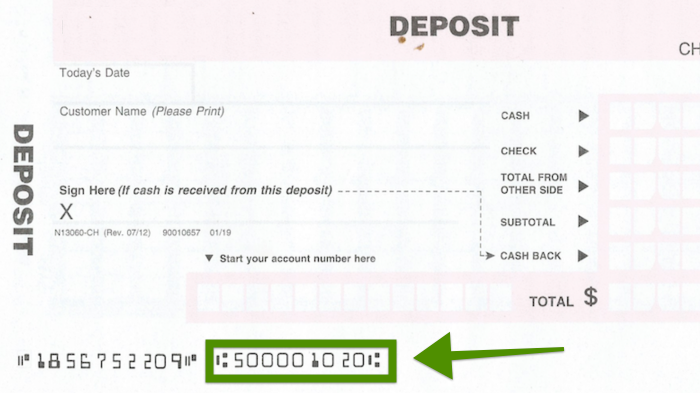

Step 8: Enter The Bank Routing Number

The routing number for your Actuarial Benefits & Design - Participant account. IMPORTANT: MAKE SURE THIS IS THE CORRECT ROUTING NUMBER FOR YOUR ACCOUNT.

You can find and verify your routing number a few ways:

- Look at the number on the lower left of a check or deposit slip, see the figure below.

- Call Actuarial Benefits & Design - Participant and verify

- Login to your Actuarial Benefits & Design - Participant online account, they show routing and account numbers in a link by each account

Actuarial Benefits & Design - Participant includes a routing number on its deposit slips, but THIS MAY NOT BE THE CORRECT ONE FOR YOUR ACCOUNT. Use the methods above to validate you enter the correct routing number.

This is a sample deposit slip for Actuarial Benefits & Design - Participant. DO NOT USE this routing number. Make sure you enter the correct routing number for your specific account.

This is a sample deposit slip for Actuarial Benefits & Design - Participant. DO NOT USE this routing number. Make sure you enter the correct routing number for your specific account.

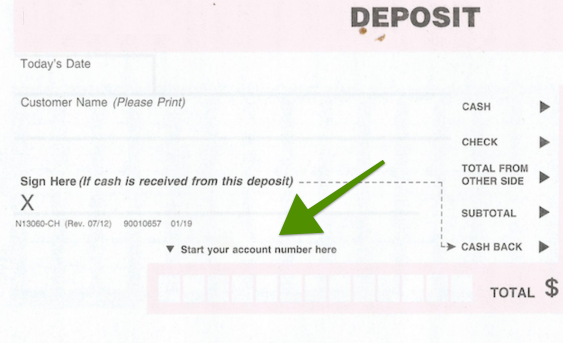

Step 9: Enter Your Account Number

Enter your account number. Double check this to make sure you enter this correctly, if you enter the wrong account number your money may end up in someone else's account. You can find your account number a few ways:

- Look at the number on the lower middle of a check, see the figure below.

- Call Actuarial Benefits & Design - Participant and verify

- Login to your Actuarial Benefits & Design - Participant online account, they should show your account number on your statements

The spot for your account number on a Actuarial Benefits & Design - Participant Deposit Slip. Double check the account number to make sure your money goes into your account.

The spot for your account number on a Actuarial Benefits & Design - Participant Deposit Slip. Double check the account number to make sure your money goes into your account.

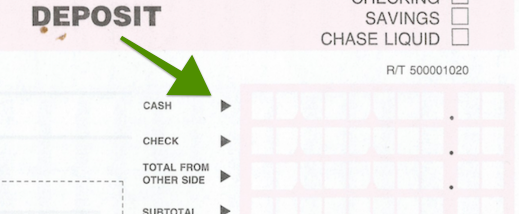

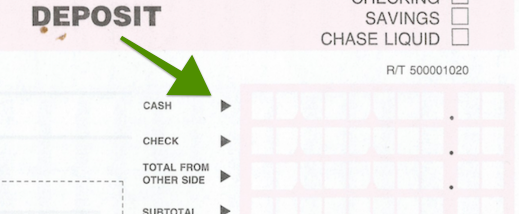

Step 10: Enter Amount of Cash to Deposit (in bank only)

Enter the amount of cash you will deposit. WARNING: only deposit cash at an ATM or in a bank branch, do not send cash through the mail.

The amount of cash you will deposit

The amount of cash you will deposit

Step 11: List Each Check to Deposit

Enter amount of each check you will deposit. If depositing one check, list on the front of the deposit slip. If depositing multiple, list each check on the back.

If depositing one check, list the check on the front of the Deposit Slip

If depositing one check, list the check on the front of the Deposit Slip

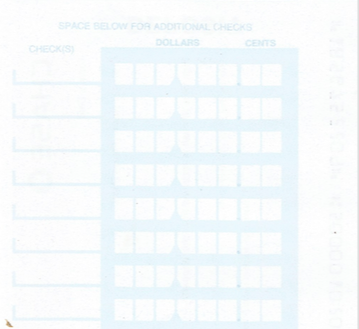

If depositing multiple check, list each on the back of the Deposit Slip

If depositing multiple check, list each on the back of the Deposit Slip

You can add all of your checks after clicking the "Create Deposit Slip" button at the end of this page.

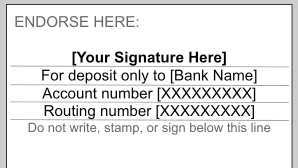

Step 12: Sign Each Check "For Deposit Only"

You don't want your money ending up in someone else's account, so sign each check using a "restrictive endorsement". A "restrictive endorsement" tells the bank exactly which account the money should deposit into.

To do this, write, "For deposit only to account number: xxxx routing number: yyyyy" where xxxx is your account number and yyyyy is your routing number . To be extra safe, also sign the check, making sure your name is listed as an account holder on the account.

Endorsing a check "for deposit only" with your signature, account number, and routing number provides the most security.

Endorsing a check "for deposit only" with your signature, account number, and routing number provides the most security.

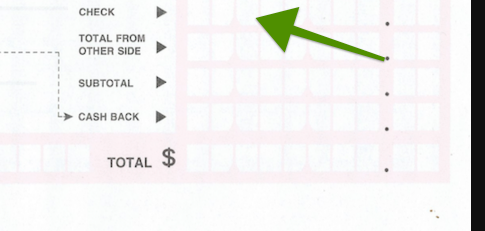

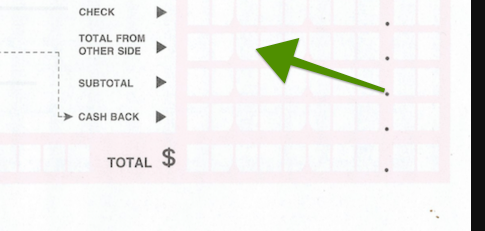

Step 13: Total All Amount of All Checks

If you listed multiple checks on the back, add up the amount of all checks and put the total in the "Total From The Other Side" field. We will do this automatically for you.

Sum up the amounts of all the checks and enter it.

Sum up the amounts of all the checks and enter it.

CheckDeposit.io will calculate this for you when you create your deposit slip.

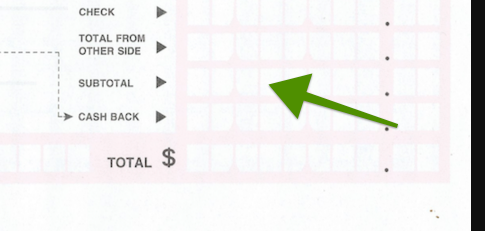

Step 14: Total Cash and Checks

Add the amounts of any cash and checks and enter in the "subtotal" field. We will do this automatically for you.

Sum up all amounts of checks and cash and enter it.

Sum up all amounts of checks and cash and enter it.

Step 15: Enter Cash Back (In-Branch Deposit Only)

If you will make your deposit at a bank and want cash back, enter your desired amount of cash back. WARNING: only fill this out if you plan to make your deposit at the bank. Banks will not send cash through the mail.

Enter the amount of cash back you want

Enter the amount of cash back you want

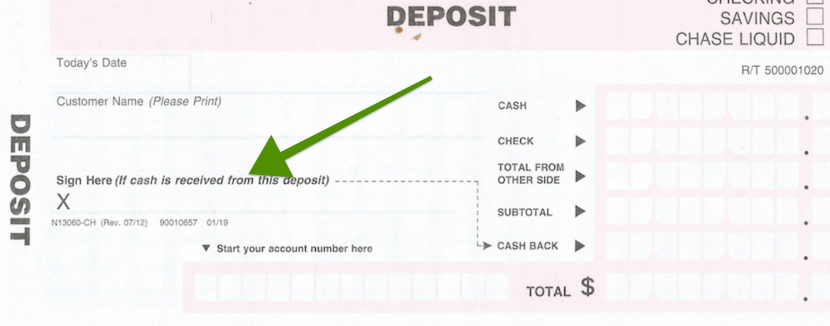

Step 16: Sign Your Deposit Slip (In-Branch Deposit Only)

If you will get cash back from your deposit, sign the deposit slip. If you will not get cash back, you do not need to sign it.

Sign the deposit slip if you will get cash back

Sign the deposit slip if you will get cash back

Options to Make Your Actuarial Benefits & Design - Participant Deposit

You have a few options to make your Actuarial Benefits & Design - Participant deposit.

- Take your deposit to the bank

- Deposit with the Actuarial Benefits & Design - Participant mobile app

- Mail in your deposit (RECOMMENDED)

We break down each option below.

Option 1: Taking Your Deposit to The Bank

You can always take your deposit to the nearest bank branch. This is the only option if you need cash back.

Advantages

- No limits on the amount of the deposit or number of checks

- Free coffee and candy

Disadvantages

- Can take a lot of time getting to the bank and back

- Waiting in line

- Bank is only open during banking hours

- No automatic recordkeeping and accounting integration like CheckDeposit.io

Option 2: Deposit with the Actuarial Benefits & Design - Participant Mobile App

Depositing with a bank's mobile app gives an easy alternative to taking your deposit to the bank.

Advantages

- Faster than going to the bank or an ATM (at least to make the deposit, not to get the funds)

- No deposit slip required

- Deposit anytime

Disadvantages

- You get access to your money more slowly. Banks often hold funds deposited via their mobile app for longer hold periods than traditional deposits.

- Mobile deposit limits may not let you deposit large checks, or a large number of checks. Banks limit both how much you can deposit daily and monthly.

- No automatic recordkeeping and accounting integration like CheckDeposit.io

Option 3: Mail in Your Actuarial Benefits & Design - Participant Deposit (RECOMMENDED)

It may sounds strange in these modern times, but mailing in your deposit with a CheckDeposit.io deposit slip offers you the best combination of convenience, speed in getting your funds, and recordkeeping. CheckDeposit.io even lets you print a deposit envelope with a fully-paid stamp so you don't need to go buy stamps.

Click the button below to make and print your own Actuarial Benefits & Design - Participant deposit slip, using CheckDeposit.io's deposit slip template.

Advantages

- Faster than going to the bank or an ATM

- No deposit limits on the size or amount of checks

- Fast access to funds than a mobile deposit

- Deposit anytime

- Fully stored and searchable check and deposit records with CheckDeposit.io

- Automatic recordkeeping and accounting integration with CheckDeposit.io

Disadvantages

- You need access to a printer and an envelope (CheckDeposit.io can print the stamp for you)

Click the "Create Deposit Slip" button below to create your deposit slip. Make sure you filled in each field above. You can enter check information on the next screen.